The Best Guide To Summitpath Llp

Table of ContentsThe 10-Second Trick For Summitpath LlpSummitpath Llp Fundamentals ExplainedSummitpath Llp Fundamentals ExplainedThe Ultimate Guide To Summitpath Llp

Most lately, introduced the CAS 2.0 Practice Growth Coaching Program. https://www.goodreads.com/user/show/191560170-summitpath-llp. The multi-step mentoring program consists of: Pre-coaching placement Interactive group sessions Roundtable conversations Individualized mentoring Action-oriented mini prepares Firms aiming to broaden into advising services can additionally turn to Thomson Reuters Method Onward. This market-proven technique provides web content, devices, and guidance for companies thinking about advisory servicesWhile the modifications have opened a number of growth chances, they have actually also resulted in difficulties and issues that today's firms need to have on their radars., firms must have the capacity to quickly and effectively carry out tax obligation study and improve tax coverage performances.

Additionally, the brand-new disclosures may cause an increase in non-GAAP steps, historically a matter that is highly scrutinized by the SEC." Accountants have a whole lot on their plate from governing modifications, to reimagined company models, to a rise in customer expectations. Equaling everything can be challenging, yet it does not need to be.

The smart Trick of Summitpath Llp That Nobody is Talking About

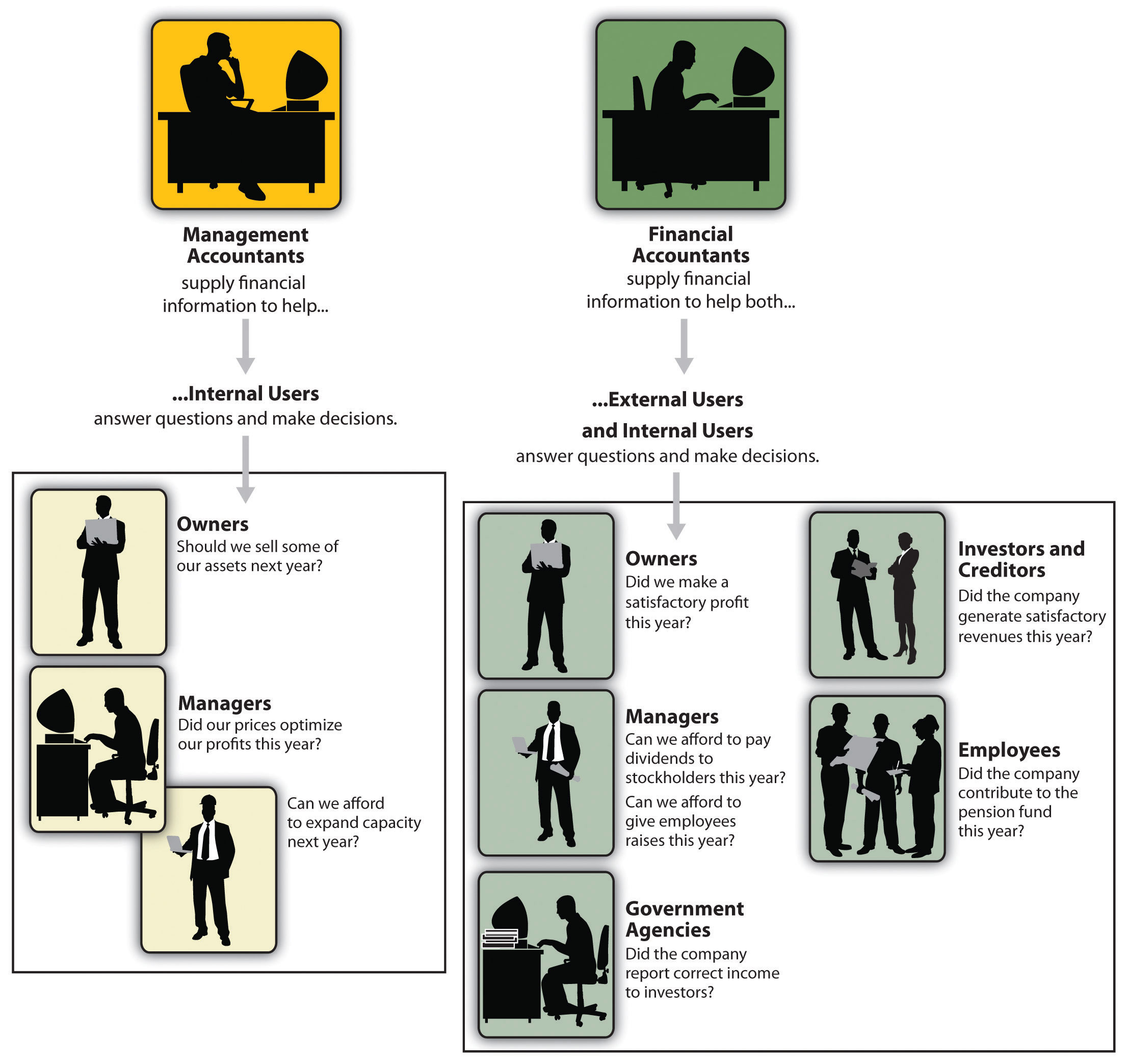

Listed below, we define 4 CPA specialties: taxation, management audit, economic coverage, and forensic accounting. CPAs specializing in tax assist their customers prepare and submit tax obligation returns, reduce their tax concern, and stay clear of making blunders that might result in pricey fines. All Certified public accountants require some understanding of tax legislation, but specializing in taxation means this will be the emphasis of your work.

Forensic accountants typically begin as general accounting professionals and move right into forensic accounting duties over time. CPAs who specialize in forensic accounting can sometimes relocate up right into administration accountancy.

No states need a graduate degree in bookkeeping., bookkeeping, and taxation.

And I suched as that there are whole lots of different work alternatives and that I would certainly not be unemployed after college graduation. Accounting also makes useful sense to me; it's not just theoretical. I such as that the debits constantly need to equate to the my website credits, and the annual report needs to stabilize. The CPA is a crucial credential to me, and I still obtain continuing education and learning credit ratings yearly to stay up to date with our state demands.

Excitement About Summitpath Llp

As an independent expert, I still use all the fundamental foundation of bookkeeping that I discovered in university, seeking my CPA, and operating in public accounting. One of things I really like regarding audit is that there are several different jobs offered. I determined that I desired to begin my job in public audit in order to learn a great deal in a short time period and be subjected to different sorts of clients and different locations of accounting.

"There are some offices that do not desire to take into consideration a person for an audit role who is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a really useful credential, and I intended to position myself well in the industry for different jobs - Calgary CPA firm. I decided in university as a bookkeeping major that I intended to try to get my certified public accountant as quickly as I could

I have actually fulfilled lots of fantastic accounting professionals that don't have a CERTIFIED PUBLIC ACCOUNTANT, however in my experience, having the credential really aids to promote your experience and makes a distinction in your compensation and career alternatives. There are some work environments that don't intend to consider a person for a bookkeeping role that is not a CERTIFIED PUBLIC ACCOUNTANT.

Some Known Details About Summitpath Llp

I actually delighted in functioning on numerous kinds of projects with various customers. In 2021, I chose to take the following action in my accountancy job trip, and I am currently a self-employed accounting specialist and service advisor.

It remains to be a growth area for me. One important top quality in being a successful certified public accountant is really caring about your clients and their companies. I enjoy collaborating with not-for-profit customers for that extremely factor I feel like I'm actually adding to their goal by helping them have excellent monetary details on which to make smart service decisions.